401k to roth ira rollover calculator

Please verify with your plan administrator that your distribution is eligible for a rolloverconversion. A Solo 401k plan a SEP IRA a SIMPLE IRA or a Profit Sharing plan.

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

Rolling over a 401k into a new or existing traditional or Roth IRA is just one option to consider.

. Pros You can roll Roth 401k contributions and earnings directly into a Roth IRA tax-free. Call 866-855-5635 or open a Schwab IRA today. A 401k rollover is a transfer of money from an old 401k to another 401k or an IRA.

Options include roll it leave it move it or take it. Future Value Before Taxes The value of ones asset at the end of the term before taxes are paid. And the penalties and taxes you have to pay on that money depend on the type of retirement account it came from.

Annual contributions are taxed upfront and all earnings are federal tax-free when they are distributed according to IRS rulesThis is much different than a Traditional IRA which taxes withdrawalsContributions can be withdrawn any time you wish and there are no required. You may be able to roll over to a Traditional or Roth IRA roll over to a 401k at a. Related Retirement Calculator Investment Calculator Annuity Payout Calculator.

Choosing between a Roth vs. If you roll over your 401k into an IRA youll also want to consider the kind of rollover you need. A Roth IRA is an individual retirement account that offers the opportunity for tax-free income in retirement.

Decide if you want to manage the investments in your IRA or have us do it for you. Rolling over a 401k into a new or existing traditional or Roth IRA is just one option to consider. A rollover IRA is typically referring to an IRA whether traditional or Roth that receives assets in a roll over from an employer-sponsored retirement plan account.

You can use our IRA Contribution Calculator or our Roth vs. As soon as those 60 days are up the money from the IRA is considered to be cashed out. Traditional IRA depends on your income level and financial goals.

401k traditional IRA or Roth IRA. Traditional IRA Calculator can help you decide. Solo 401k Contribution Calculator Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings.

The major difference between Roth IRAs and traditional IRAs is that contributions to the former are not tax-deductible and contributions not earnings may be withdrawn tax-free. Traditional IRA comparison page to see what option might be right for you. Generally pretax assets are rolled into a rollover IRA or traditional IRA.

A Rollover IRA is a retirement account that allows you to move funds from a 401k from a previous employer to an IRA. You may gain tax benefits by converting funds from employer-sponsored retirement plans such as a 401k into a Roth IRA. You can choose to roll pretax savings into a Roth IRA but doing so would be treated as a taxable event.

Roth IRAs have income limits. As your income increases the amount you can contribute gradually decreases to zero. A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free income in retirement.

Lump-sum Distribution The withdrawal of funds from a 401k. Penalties The payment demanded for not adhering to set rules. Similarly you can roll after-tax savings into a traditional IRA but this requires.

Heres how to do a 401k rollover in 4 steps without a tax bill. 401k Withdrawing money from a 401k early comes with a 10 penalty. With a Roth 401k youll likely be more interested in a Roth IRA so that you can.

Roll over your 401k to a Roth IRA If youre transitioning to a new job or heading into retirement rolling over your 401k to a Roth IRA can help you continue to save for retirement while letting any earnings grow tax-free. Rollover Moving the 401k contribution to another retirement fund option often an IRA. After-tax assets Roth 401k or after-tax savings are rolled into a Roth IRA.

RCH Auto Portability is the enhanced standard of care for an automatic rollover program reducing cashouts by 52 while helping participants receiving mandatory distributions. As a result the assets in your retirement account remain tax-deferred. Learn more about the pros and cons of your choices for rolling over your 401k.

We will help you understand the potential considerations of what a 401k has to offer so you can make a more informed decision about what is right for you. Learn about Roth IRA conversion. We can also help with Roth IRA and 401k conversions.

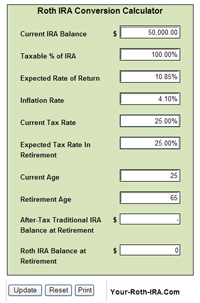

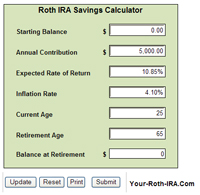

What Is The Best Roth Ira Calculator District Capital Management

Ira Calculator See What You Ll Have Saved Dqydj

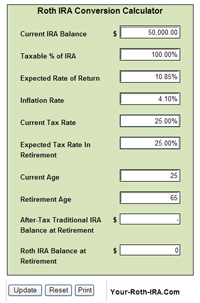

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

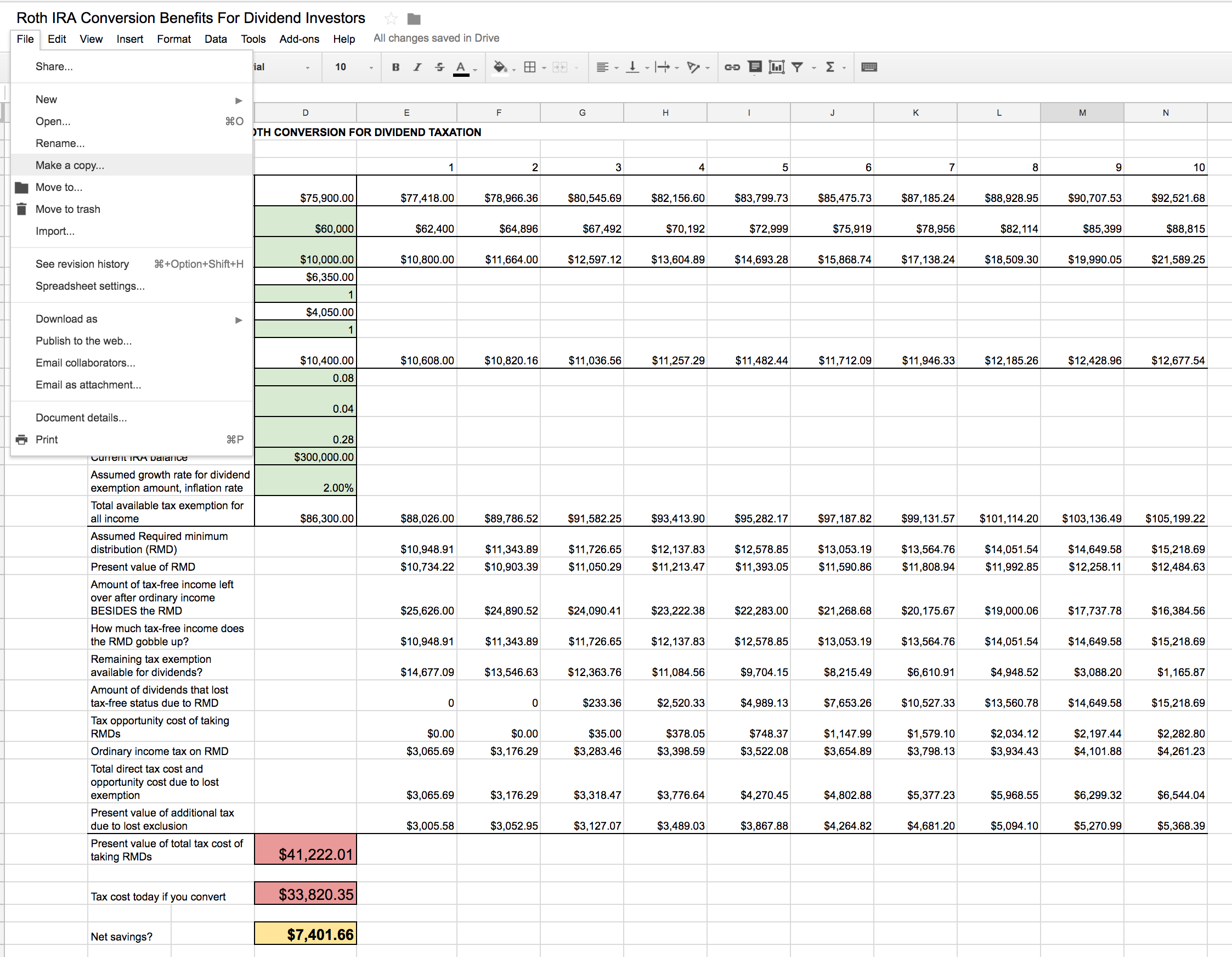

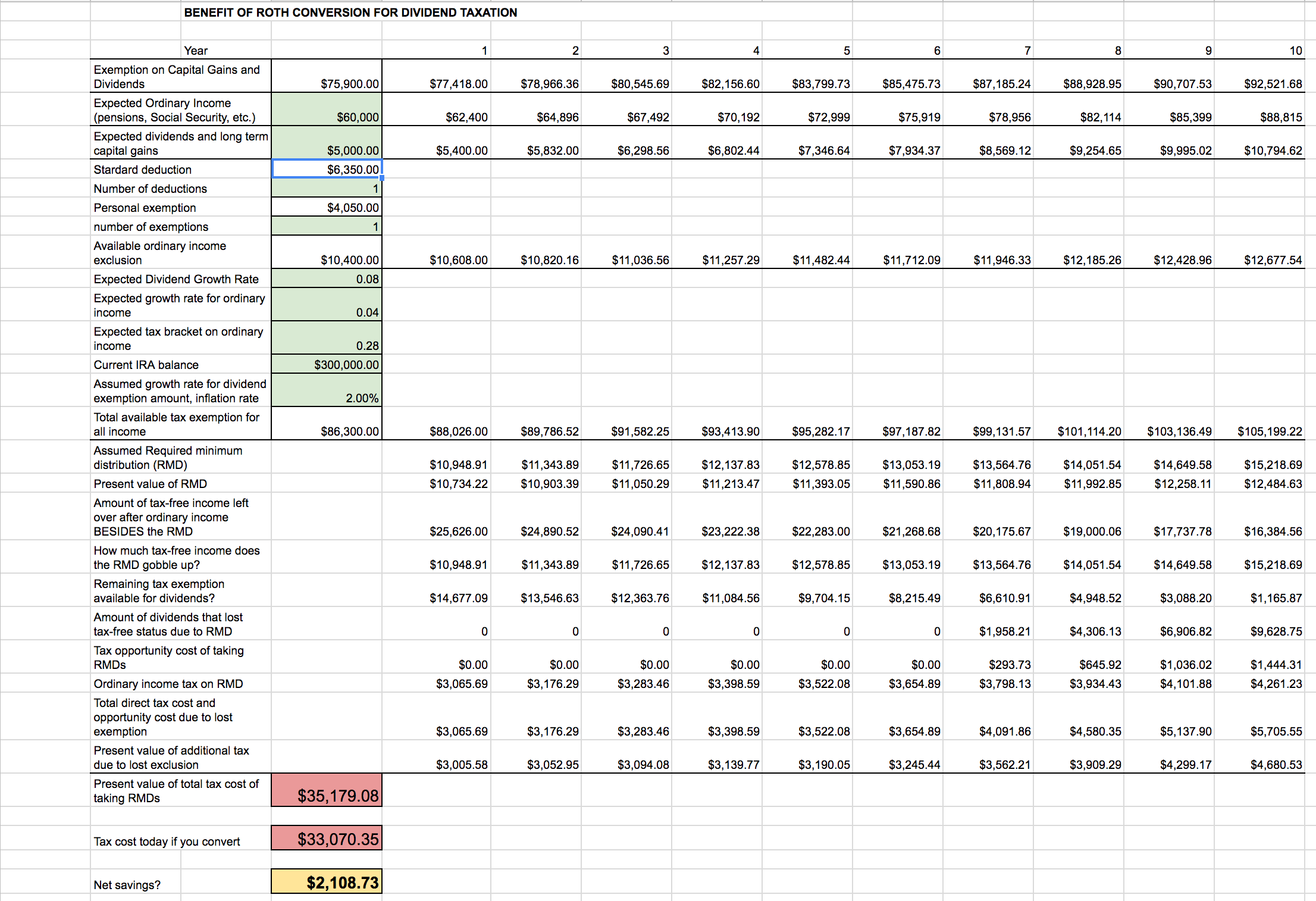

Roth Ira Conversion Spreadsheet Seeking Alpha

Roth Ira Calculators

Traditional Vs Roth Ira Calculator

What Is The Best Roth Ira Calculator District Capital Management

401k Rollover Calculator To Roth Traditional Sep Or Simple Ira

Traditional Vs Roth Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculator Roth Ira Contribution

Roth Ira Conversion Spreadsheet Seeking Alpha

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculators